Bank Reserves and Treasuries: Like Savings and Checking Accounts at the Fed?

Dan wrote: Are Bank reserves at the fed equivalent to a checking account and treasury accounts at the fed equivalent to savings accounts as MMT proponents contend?

No, not at all. These two images demonstrate the point.

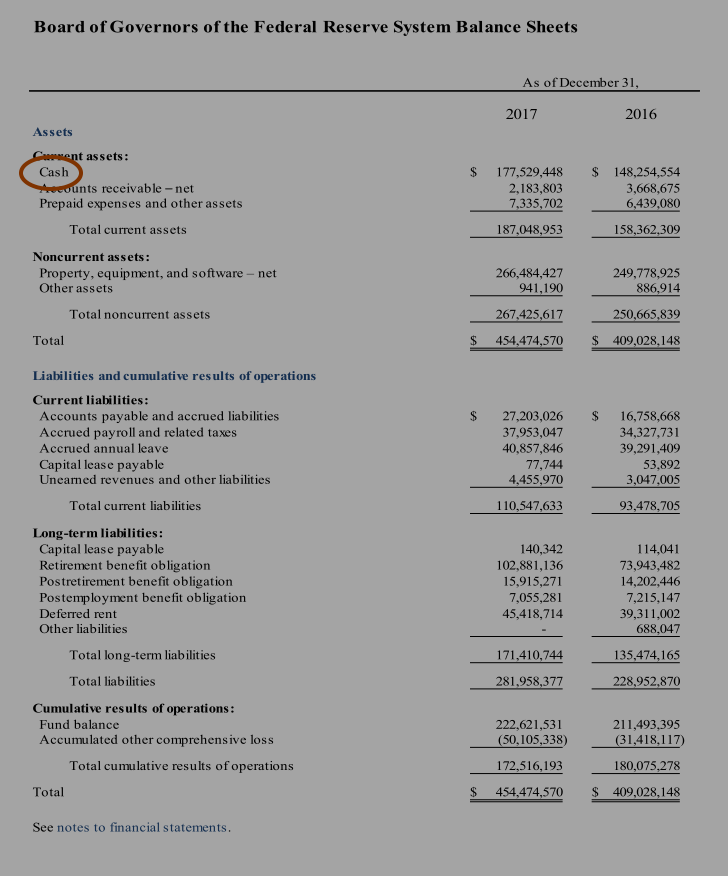

First is a balance sheet of the Board of Governors, the Federal agency in Washington DC. It’s commonly called the “Central Bank” but we can see here it isn’t a bank. It sets interest rates, makes monetary policy, and promulgates banking regulations.

via Board of Governors of the Federal Reserve System – Balance Sheets – 2017 – PDF

We can see that cash is an asset to the Board of Governors. About $177.5 million. The majority of its liabilities are personnel related. Nobody has deposits here. The Board owns no Treasuries on the asset side of the sheet, shows no Treasuries as its own debt on the liability side. It certainly could own Treasuries; they’d be intragovernmental holdings. But it doesn’t.

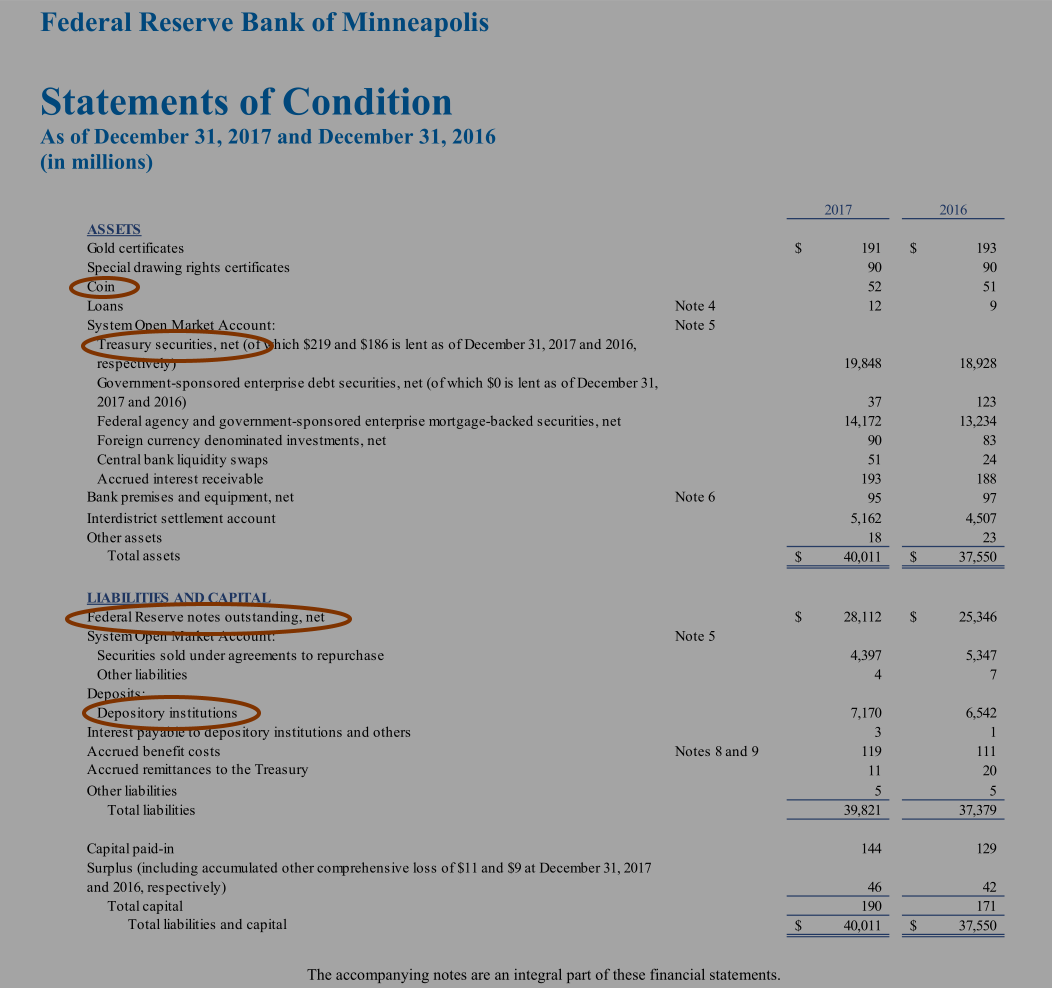

Compare this to the 2017 financial statement of the Federal Reserve Bank of Minneapolis. Reminder that the Reserve Banks acknowledge they’re not part of the US Government. USG owns not a single share.

via Federal Reserve Bank of Minneapolis – Statement of Conditions 2017 – PDF

Cash is not an asset to FRBM, save for the coins. Treasuries and other USG securities constitute the bank’s primary assets. The bank has millions or billions face value of Reserve Notes in its vaults but they’re neither asset nor liability under FRBM’s ownership. The bank can easily shred its unfit notes, and order more (or not, depending on customer demand for paper currency), without materially affecting its balance sheet. Compare to USG, which we’ve shown books even mutilated paper currency as an asset.

On the liabilities side, first item is, yes, Federal Reserve notes outstanding, net. Deposits owned by depository institutions, commonly known as Reserve Balances, are the bank’s second largest liability. The item Accrued Remittances to the Treasury represents the bank’s unpaid tax bill. The Treasury General Account is a liability of FRBNY, so here at FRBM Accrued Remittances appears to be the only debt to USG.

Rhetorical question: If Treasuries are savings accounts at the “Fed” and reserve balances are checking accounts at the “Fed”, why are they on opposite sides of the balance sheet?

For the MMT depiction, let’s cite the great Bill Black in New Economic Perspectives:

[I]f the Fed is buying our debt, then it is not in fact debt. It is simply an accounting game. If Division A of Corporation Z “sells” bonds to Division B of Corporation Z there is no change in Corporation Z’s debt levels. That fact should have led Whitehead and Romney to ask why Treasury was bothering to “sell” U.S. debt to the Fed. The Fed’s surplus goes to the Treasury, so the Whitehead and Romney theory cannot be that Treasury has “run out of money” and the Fed has a trillion dollars in “extra” “money” that it is lending to the Treasury as a last gap effort to delay the inevitable default on U.S. bonds. The Fed could simply send its hypothetical $1 trillion in “extra” “money” to the Treasury as a component of its annual “distribution” to the Treasury.

Bill Black

via Romney is shocked to learn how the Fed creates money

http://neweconomicperspectives.org/2012/10/romney-is-shocked-to-learn-how-the-fed-creates-money.html

There is no doubt that MMT imagines the Reserve Banks and the Treasury to be two “divisions” of the same entity, USG. But are reserve notes and reserve balances counted as USG debt? Answer: no. Are Treasuries owned by the Reserve Banks intragovernmental holdings? Answer: no, they’re counted as Debt Held by the Public.

Federal Reserve Banks are franchises, not unlike the companies that are permitted to mine ores on US Government property. The Banks’ remittances were known as Franchise Taxes until 1933.

12 U.S. Code § 502 – Liability of shareholders of Federal reserve banks on contracts, etc.

The shareholders of every Federal reserve bank shall be held individually responsible, equally and ratably, and not one for another, for all contracts, debts, and engagements of such bank to the extent of the amount of their subscriptions to such stock at the par value thereof in addition to the amount subscribed, whether such subscriptions have been paid up in whole or in part under the provisions of this chapter.

via 12 U.S. Code § 502 – Liability of shareholders of Federal reserve banks on contracts, etc. | LII / Legal Information Institute

http://www.law.cornell.edu/uscode/text/12/502

So the TGA is ultimately debt of the Reserve Banks’ shareholders to the USG, and the FRB-owned Treasuries are debt of the USG to the Banks’ shareholders. Thus: the Reserve Banks aren’t the USG; they’re the USG’s creditors.

Does Dr. Black imagine that the Reserve Banks and their shareholders can be compelled to credit USG with $1T in checkwriting balance without recompense?

When Reuters used a Freedom of Information Act request to investigate some cybersecurity breaches in the Federal Reserve System a few years ago, the reporters noted:

The records represent only a slice of all cyber attacks on the Fed because they include only cases involving the Washington-based Board of Governors, a federal agency that is subject to public records laws. Reuters did not have access to reports by local cybersecurity teams at the central bank’s 12 privately owned regional branches.

http://www.reuters.com/article/us-usa-fed-cyber-idUSKCN0YN4AM

Now we can certainly find careless financial journalism that describes the Federal Reserve System as a consolidated entity. But this piece accurately conveys that reporters who seek to use FOIL on the Reserve Banks will themselves be foiled. The Reserve Banks are privately owned, not part of the government, and any constraints on the government’s powers to draw on their shareholders’ liabilities are not self-imposed, they’re contractual and definitional.